In this blog series on US Taxes and fixed assets I’ve covered several basic concepts. How SAP tracks the tax books separately from other areas, some basic tax calculations, and how SAP supports tax specific adjustments.

Blog Series: Handling US Tax Depreciation in SAP (Part 1): The Basics Handling US Tax Depreciation in SAP (Part 2): Separate Books Handling US Tax Depreciation in SAP (Part 3): Basis Adjustments

Handling US Tax Depreciation in SAP (Part 4): Prior Year Adjustments

Handling US Tax Depreciation in SAP (Part 5): Mid-Period and Mid-Quarter Convention

Handling US Tax Depreciation in SAP (Part 6): IRS Passenger Vehicles

Handling US Tax Depreciation in SAP (Part 7): Tax Forms 4562 & 4797

But what do you do if you have to make these changes in a prior year? Does SAP support that?

Prior Year Adjustments

The business cycle in tax lags the day-to-day operational cycle that general accounting, sales, HR and purchasing follow. That means that it’s rare for them to make tax changes in the current year. In FI-AA, nearly 100% of the tax work we have to do involves making changes and adjustments in prior years.

Q: But aren’t those prior years closed? Is it possible to make these changes in a prior closed fiscal year?

A: Yes and Yes.

Example

In this example I’m going to make a transactional adjustment as I did in the earlier blog. The adjustment will be to the tax books only; the corporate book and the GL won’t be impacted. The one big difference is that I’ll be making it in a prior fiscal year that has already been closed. The goal is to run a year-end 2018 report and see updated tax values. Of course, this will impact the 2019 and current 2020 reports as well but for now, the goal is to get a 2018 year end value correction made.

Keep in mind that this concept is the same if you had to change the depreciation terms (depreciation key, useful life, scrap amount, start date, etc.) and then recalculate depreciation for a prior closed year. Same situation with a slightly different process.

Review the Fiscal Year Settings

First, let’s set the table. Below is a simple asset with $10,000 in cost that was originally capitalized back in 2018.

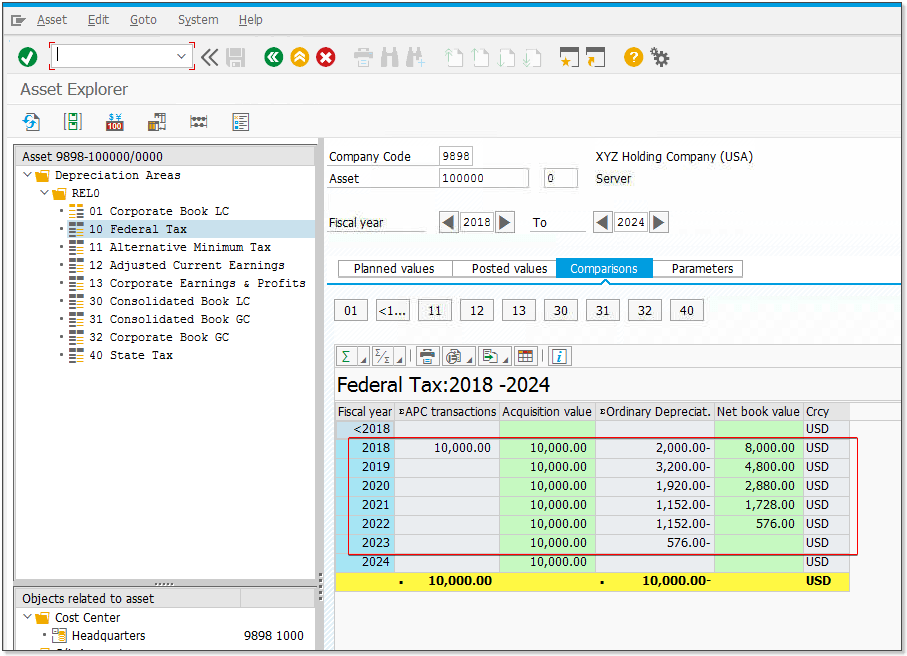

Below is the multi-year view of the asset’s cost. This is a 5 year asset in the federal tax (MACRS) book so the depreciation amounts for a $10,000 basis record should look familiar (from the earlier blog).

Below is a screenshot of the table that stores the closed FY. As you can see, this is maintained per company code and depreciation area. Currently, 2019 (and all preceding years) is closed.

Below is a screenshot that is new to S/4HANA. This configuration screen was introduced in S/4HANA 1709 for legacy conversion purposes, and was enhanced in the 1909 release to manage the closed and current fiscal years as shown below. Note that the closed FY is 2019 (and all preceding years) and that the ‘current’ FY is 2020. Technically, this [Highest Fiscal Year] field stores the year that was rolled forward. It could say 2021 if I ran the balance carry forward at FAGLGVTR… but both the most recently rolled forward FY and the current FY is the same in this case; 2020. To be clear, this new configuration screen is showing the same information as the above screenshot. Same data, just displayed differently.

What does this all mean?

Well, the asset was capitalized in 2018 but we’re now in the year 2020. Years 2018 and 2019 are both closed. If I make the basis adjustment in 2020, I can only use a 2020 posting date which means that my reports for the tax books in 2018 won’t be any different. This isn’t what I want to do… I want the posting to be made in 2018 so that I can re-run my 2018 reports and have the necessary basis adjustments made.

Moving On to Making the Changes

Now, Tax wants to do a basis adjustment for this asset and they want it back in 2018. Let’s say that during an audit they find that some of this $10,000 cost included certain charges which were not allowed to be capitalized for this asset. Another example that I’ve had a lot of this year is transferring tax values to sub assets with different useful lives… because corporate accounting capitalized the full cost as a single asset using a single depreciation method but for tax the cost detail shows that some should be MACRS 5 years, others MACRS 7 and others MACRS 15. Either way, I’m just going to credit this asset by $4,000 in this example. The trick… or rather, the concern… is that this only be done on the tax book and that the corporate book not be touched, all in a prior FY!

The first step is to reverse the fiscal year for the tax books. As you can see below, the year has been reversed so that 2018 is now open for the tax depreciation areas (10-13). The other areas, most importantly area 01 which posts to the GL, are still closed and only allow updates as of FY 2020.

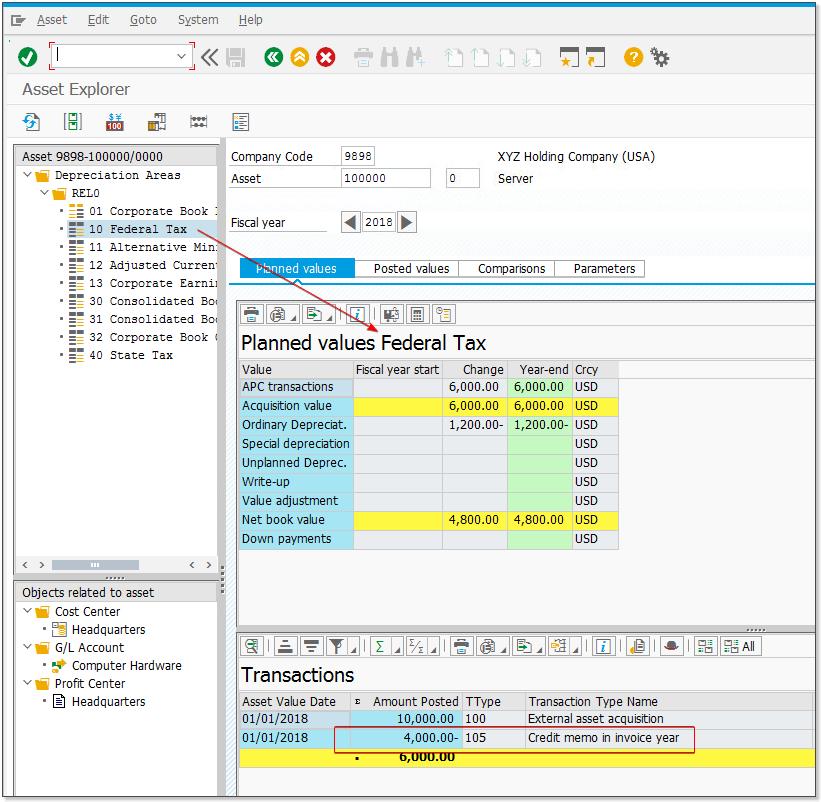

I’ve made the asset posting in 2018 and now its cost basis has been adjusted down from $10k to $6k. Notice that this was done in FY 2018 and that the basis value has been correctly updated with the -$4k line item.

Looking at area 01, no posting was recorded against the area. Its basis value (APC) is still $10k in 2018 (and all years in this example).

Heading back to the tax area to look at the depreciation calculation, I see the same 5 year calculations that I would expect… 20% in year 1, 32% in year 2, etc. but the calculated amounts are different because the basis has been adjusted.

Now that I’ve confirmed the values, I’ll close the FY to make sure that all areas are closed for 2019. All done!