The first two blogs covered both some general information on revaluations as well as SAP’s solution for them. This blog will dive into a specific example to show you how an asset can be revalued at AR29N and what it looks like afterwards. Keep in mind that this is just a demo of one record but the tool has an upload capability to easily revalue as many assets as you need for a full revaluation project.

Blog Series:

The Correct Way to Handle Fixed Asset Revaluations in SAP with AR29N (Part 1)

The Correct Way to Handle Fixed Asset Revaluations in SAP with AR29N (Part 2)

The Correct Way to Handle Fixed Asset Revaluations in SAP with AR29N (Part 3)

Example

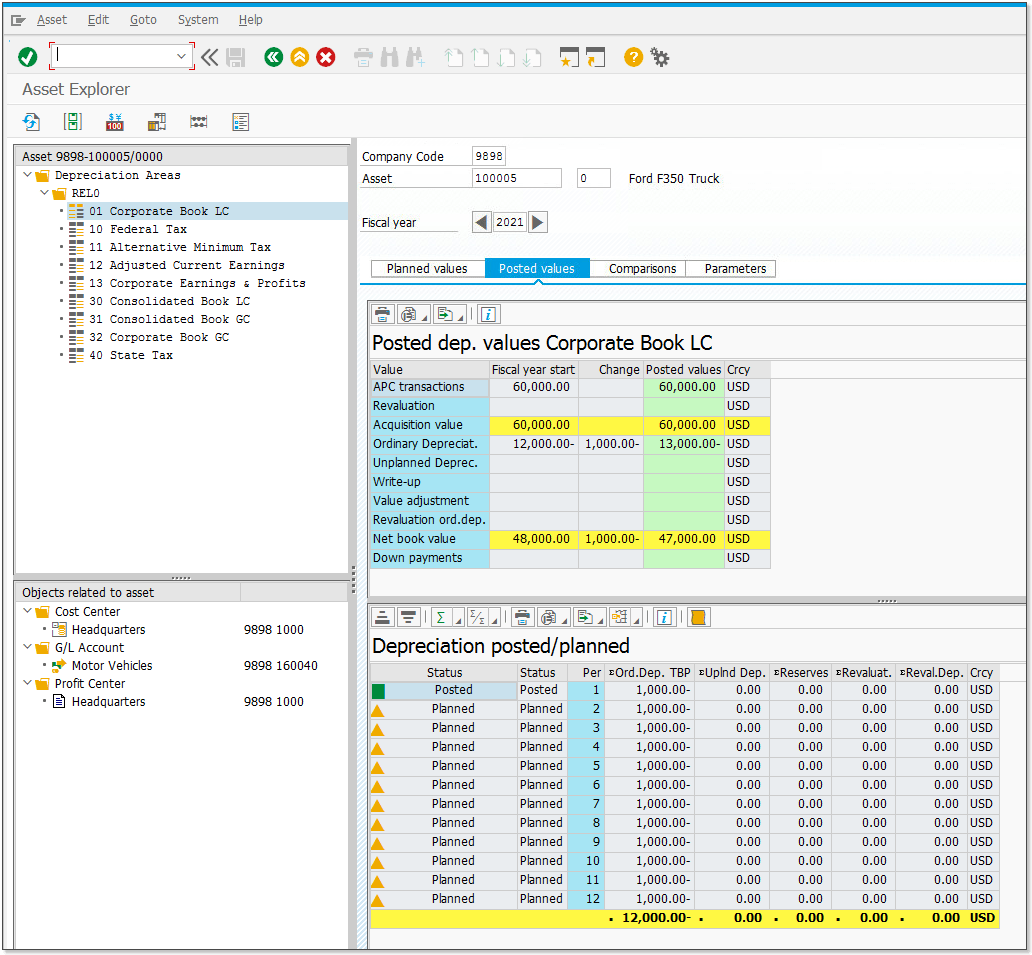

Below is the example asset that I’m going to revalue. A few things to note:

- This asset is an existing record that was acquired in a prior year. Specifically, it was capitalized in January 2020 for $60,000 USD.

- It has a 5 year life and is depreciating using a normal straight line convention. $60k for 60 periods comes out to an even $1,000 in depreciation per month. For 2020, it received a full 12 periods of depreciation which amounts to $12,000, leaving a NBV of $48,000.

- In 2021, there were no additional transactions.

- Lastly, I’m only working on area 01 for this example. As I wrote about earlier, this is not always the case as the tax values are often revalued as well but I’m just trying to keep this complicated topic as simple as possible!

Here is the Posted Values tab for 2021. January depreciation has already been posted. This means that as of the end of January, it’s current NBV is $47,000 and it’s accumulated depreciation is $13,000. Note the even $1,000 in depreciation per month shown at the bottom.

What’s the Goal?

I need to revalue the asset as of the end of January (1/31/2021). I mentioned earlier that this is not normally the case… normally we have to go back several periods and even into prior closed FY to make the revaluation but that is an implementation issue. Since reversing the depreciation run is a consulting service that we provide, I’m not going to walk through how that program works… I’m just going to keep the example straightforward and revalue it as of 1/31/2021.

For this particular asset, I could revalue it to its NBV of $47,000 but will instead revalue it down to $42,300. Why did I choose $42,300? The first reason is just to show how the values show up in SAP which shows off how AR29N is a bit more superior than other manual methods of handling this. Secondly, the math below should make it clear:

- NBV = $42,300

- Original UL = 60 periods

- Expired UL = 12 periods in 2020 + 1 in 2021 = 13 periods

- Remaining UL = 47 periods

- Monthly Depreciation = $42,300 / 47 = $900

The goals are the following:

- I want to get the asset’s Acquisition Cost to the new appraised value of $42,300

- A/D should be backed out to 0.00

- The go-forward depreciation should be a consistent $900/period. Obviously, I don’t want any one-time adjustment or spike/dip in the depreciation for the next month’s run… it should immediately switch from $1,000/period in January to $900/period in February going forward.

Executing AR29N

When I execute AR29N, I can revalue the asset to it’s current NBV. This is the most common requirement. In this case, I’ve specified that the new value for this asset is it’s NBV (as of 1/31/2021) which is $47,000. As such, there is no calculated revaluation amount (the last column is zero).

I’m going to back out and re-enter the new asset value of $42,300. This type of revaluation… a negative revaluation… is the more common example. Of course it is completely possible to have a higher amount for this asset such as $50,000 or more, but the negative revaluation happens more frequently.

In the screenshot below the new asset value of $42,3000 results in a revaluation credit of $4,700. Keep this figure in mind.

Validating the Results

Once I’ve posted the entry the Asset Explorer shows some great information.

First, the revaluation transaction is shown at the bottom. That’s an FI document that you can drill into because it was posted to the GL.

Secondly, the 13 periods of depreciation that made up the asset’s A/D of $13,000 has been offset by a value adjustment of the same amount. Once the asset is rolled forward, that will be cleaned up and it will show $0.00 in A/D. In any asset report (more below), it will show the new asset value of $42,300 in APC and $0.00 in A/D. That’s what I wanted to see!

Lastly, the $4,700 credit to the asset’s value is tracked as it’s own value type. This can be easily reported on in SAP. It is automatically lumped into the asset’s Acquisition Value in most of the reports (which is what most people want at a macro level) but can be pulled out so that you can track the total of all revaluation amounts for the company separate from the original acquisition postings.

Below is the Posted Values tab which shows the planned and posted monthly calculations for the year. In this case, the goal was to make sure that the asset’s go-forward depreciation calculation was a consistent amount without any spike/dip in the next month’s depreciation run. If this is done correctly, you should see something like what’s below… a smooth transition. If you don’t see that, SOMETHING IS WRONG!

Moving on, here is the FI document that was generated. I can pull this up directly from the Explorer by double-clicking on the transaction line item.

- There is a $13,000 reduction in the asset’s APC.

- The prior A/D of $12,000 was backed out.

- The current year’s posted depreciation (1 month) of $1,000 was backed out.

- The new revaluation adjustment of $4,700 was credited to the asset

- The offset is to a clearing account but this can be changed easily via configuration or at runtime. Most companies have a temporary holding account from the merger/acquisition that we have to clear to.

Reporting

Lastly, let’s look at the asset report. The asset balance report was run as of 1/31/2021 (the revaluation date). The goal I had above of a new APC of $42,300 and $0.00 in A/D is correct. We’re done!

What About the Upload?

This solution above works well but most revaluations affect an entire entities assets. That is often done over multiple company codes and potentially millions of records.

The good news is that AR29N supports an upload of the data. On the 4th tab is the directory path to find the upload file that has the asset information. The program also has a test run parameter so it’s a far better option than to do this via LSMW or some other custom upload tool.

Conclusion

There are obviously some wrinkles on this process. Some companies have simple revaluations that occur throughout the year whereas for others it’s a more complex situation. In particular, this is heavily based on the quality and cleanliness of the FI-AA subledger as related to the depreciation calculations. If you have any issues in that area… and most customers will say something such as “Straight line depreciation is so easy, what could possibly be wrong?”… well, I tend to find a lot of wrong things when we have to revalue every record in a company code. If something is wrong, it will pop-up and either there will be a significant change in the next month’s depreciation run… something nobody ever wants… or the revaluation posting will error out. And all of that is just for depreciation issues. If you have assets are incomplete, fully depreciated, negative, still have un-depreciated cost, don’t tie to the GL, continuing to depreciate after their useful life has ended… well, those will cause problems too. I guess my point is that an initiative such as a revaluation will shine a bright light on the subledger. If there are any issues in it, they’ll cause problems for the project.

Please feel to reach out to us on our contact form or via Twitter, LinkedIn or via email.