When working with regulatory bodies such as FASB and IASB, the timing of their regulations and the effective deadlines are a key component. Companies have to be compliant with these new regulations as of the dates that FASB and IASB specify. Let’s review the key dates related to lease compliance.

Initial Timeline

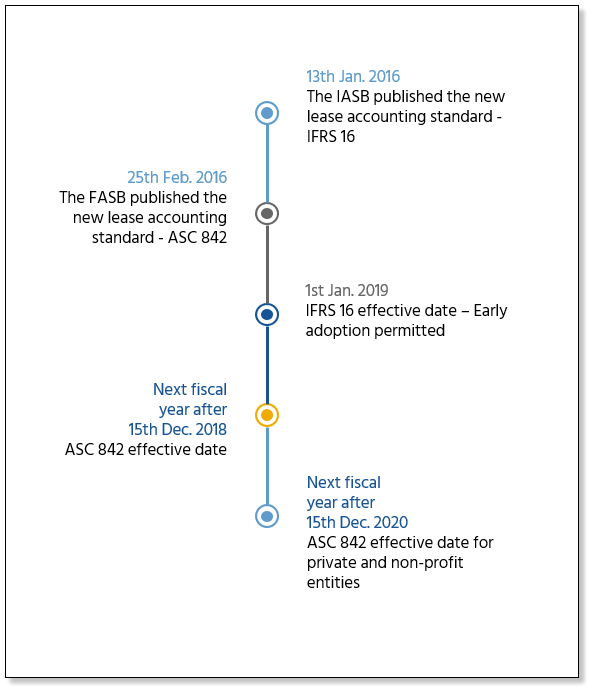

Both regulatory bodies have been working together to develop a solution for lease compliance for several years. Keep in mind, however, that these are separate bodies and have issued separate publications on this topic. While they are nearly the same, there are still some material differences. I won’t be covering those differences just yet because we are an SAP consulting practice and don’t usually get into the interpretations of accounting regulations. Related to the timeline for leasing, both bodies have issued similar deadlines for compliance. For review purposes, let’s start with their publication dates which are slightly different. IASB officially released their requirements on Jan 13th, 2016; FASB followed about a month later.

The effective date for compliance by each body was also slightly different. IASB required that companies be compliant with IFRS as of January 1, 2019. FASB took a fiscal year based approach and required that customers be compliant at the start of their next fiscal year (beginning after December 15, 2018).

Date Change for Private / Non-Profits

Both of the compliance dates above were relevant for publicly traded companies. Private companies and non-profits were granted an extra year to be compliant. IFRS 16 compliance was not required until January 1, 2020 and ASC 842 as of the fiscal year start after December 15th, 2019.

However, FASB came out of their July 2019 meetings with a revised date for private and non-profit entities. For ASC 842, FASB is granting an additional 12 months for those companies to be compliant. The new (planned) date is the start of the fiscal year after December 15th, 2020.

As of this writing, this date change is not yet confirmed. There is a 30 day public comment period where FASB will review any comments or issues from the community before making the change final. It’s not expected that there will be any dissenting opinions and the proposed change will go through. While IFRS has also not yet signaled a change for private and non-profit entities, that too could change.